Table of Contents

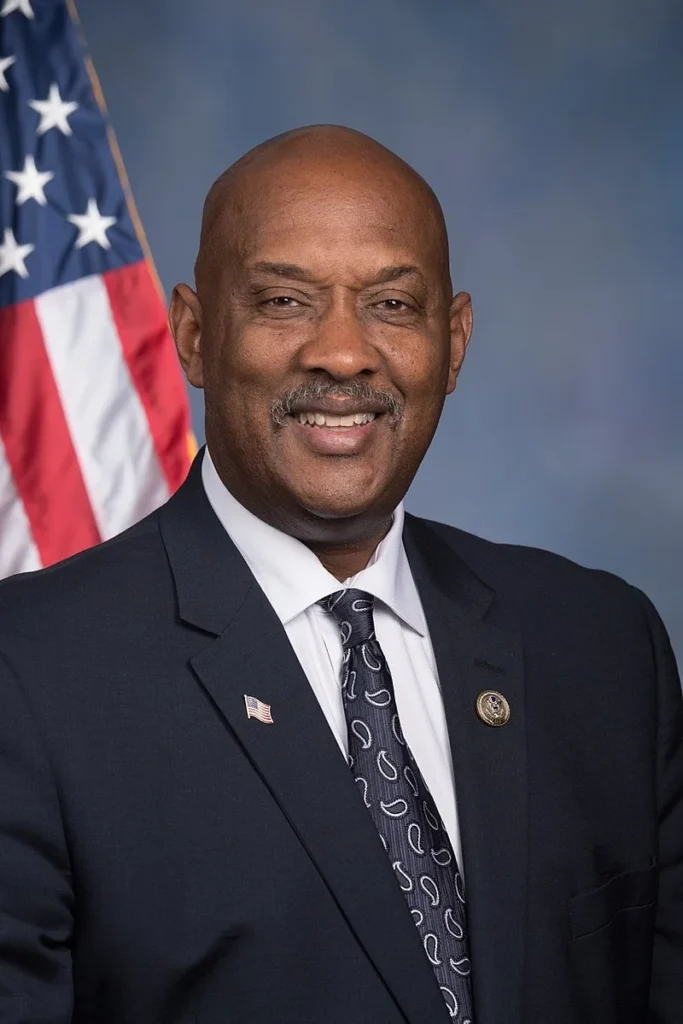

When Dwight Evans announced his retirement from Congress, it sent ripples through Pennsylvania’s political landscape—but it also offered something unexpected: a masterclass in legacy planning and graceful transition. Evans’ approach to stepping back from decades of public service provides valuable insights for anyone approaching their own retirement, whether from a corporate boardroom or a factory floor.

Most of us won’t leave behind Congressional seats, but we all face the same fundamental challenge: How do you transition from a career that’s defined you for decades to a retirement that fulfills you? Evans’ methodical approach to succession planning and his focus on ensuring continuity offers lessons that extend far beyond politics.

The Art of Strategic Retirement Timing

Dwight Evans didn’t just wake up one morning and decide to retire. His decision represents years of careful consideration about when and how to step away—a process that mirrors the retirement planning decisions we all must make. Just as Evans considered the political landscape and his district’s needs, you need to evaluate your financial landscape and your family’s needs.

Here’s what I tell my clients about timing: retirement isn’t a light switch you flip on your 65th birthday. It’s more like a dimmer switch that you gradually adjust over several years. Evans understood this, spending considerable time preparing his transition and ensuring his constituents would be well-served by his successor.

Financial Readiness vs. Emotional Readiness

One thing that strikes me about Evans’ retirement announcement is how he balanced duty with personal timing. In retirement planning, we face a similar tension between financial readiness and emotional readiness. You might have enough money saved but feel lost without your career identity. Or you might be emotionally ready to retire but worried about making your savings last 30+ years.

Consider these key indicators that you’re approaching retirement readiness:

- Your retirement savings can generate 70-80% of your current income

- You’ve developed interests and relationships outside of work

- You’ve addressed healthcare coverage for the gap between employer insurance and Medicare

- You’ve created a succession plan at work that makes you feel comfortable leaving

“The most successful retirements happen when people plan not just for financial security, but for purpose and meaning in their post-career years.”

— Michael Thompson, Certified Financial Planner

Building Your Legacy While You’re Still Working

Evans spent his Congressional career building relationships, mentoring younger leaders, and creating institutional knowledge that would outlast his tenure. This approach—building legacy while still active—is something every pre-retiree should consider, regardless of their profession.

Think about your own career: What knowledge, relationships, and institutional memory will you take with you when you leave? How can you ensure that your departure strengthens rather than weakens your organization? More importantly, how can this transition process enhance rather than diminish your own sense of purpose?

The Succession Planning Mindset

Whether you’re a CEO or a line supervisor, adopting a succession planning mindset benefits everyone. Start documenting your processes, mentoring potential successors, and gradually delegating responsibilities. This approach serves multiple purposes: it makes your eventual departure smoother, it develops talent around you, and it gives you a preview of what retirement might feel like.

I’ve noticed that clients who practice this gradual transition often adapt better to full retirement. They’ve already experienced the satisfaction of seeing others succeed with their guidance, which can ease the identity transition that retirement often brings.

The Economics of Congressional vs. Personal Retirement

While most of us won’t have access to Congressional benefits, understanding how public servants like Evans approach retirement planning can offer insights for our own strategies. Members of Congress participate in the Federal Employees Retirement System (FERS), which combines a basic pension, Social Security, and the Thrift Savings Plan (TSP)—essentially a three-legged retirement stool.

This multi-source approach is exactly what financial advisors recommend for everyone. You might not have a Congressional pension, but you can create your own three-legged stool with Social Security, employer-sponsored retirement plans like a 401(k), and personal savings including IRAs.

Lessons from Public Sector Retirement Planning

Public servants like Evans often have more predictable retirement benefits than private sector workers, but they also typically earn less during their working years. This creates an interesting planning dynamic that’s relevant for many Americans: How do you maximize retirement security when you can’t necessarily maximize income?

The answer often lies in consistency and strategic timing. Evans knew his pension benefits and could plan accordingly. You can create similar predictability by maximizing employer matches, taking advantage of catch-up contributions after age 50, and understanding your Social Security benefits.

Speaking of retirement timing decisions, many successful retirees follow a pattern similar to what we see in other high-profile career transitions. Athletes like Chris Paul face similar decisions about when to step away from careers that define them, balancing peak performance with long-term planning.

Managing the Identity Transition

For someone like Evans, who spent decades in public service, retirement represents more than leaving a job—it’s stepping away from a core identity. This challenge resonates with anyone who’s deeply identified with their career, whether you’re a teacher, engineer, or small business owner.

The research on retirement adjustment shows that people who maintain some connection to their professional identity often transition more successfully. This doesn’t mean you need to keep working part-time (though that’s an option), but it might mean volunteering in your field, consulting occasionally, or mentoring others.

Creating Purpose Beyond the Paycheck

Evans’ transition offers a blueprint for maintaining relevance and purpose after stepping down from a primary career. Consider how you might apply this to your own retirement planning:

- Identify the aspects of your work that bring you the most satisfaction

- Explore ways to continue contributing in those areas without the full-time commitment

- Build relationships and interests outside of work while you’re still employed

- Consider how your expertise might serve others in retirement

The goal isn’t to recreate your career in retirement, but to channel what you loved about your work into new opportunities for meaning and contribution.

Practical Steps for Your Own Retirement Transition

Watching Evans navigate his Congressional retirement reminds us that successful transitions don’t happen overnight. They require intentional planning, both financial and emotional. Here are actionable steps you can take, regardless of how many years you have until retirement:

Five Years Before Retirement

Start thinking seriously about your post-career identity. What will give you purpose? How will you structure your days? Begin developing interests and relationships that aren’t tied to your current job. This is also when you should get serious about catch-up contributions if you’re eligible.

Three Years Before Retirement

Run detailed retirement income projections. Meet with a financial advisor if you haven’t already. Consider your healthcare strategy—will you need COBRA, ACA marketplace coverage, or do you have access to retiree health benefits? Start documenting your job responsibilities and identifying potential successors.

One Year Before Retirement

This is succession planning time. Train your replacement, document processes, and gradually delegate responsibilities. Simultaneously, ramp up your retirement activities. If you plan to volunteer, start exploring organizations. If you want to travel, begin planning those trips.

Similar to how other professionals handle career transitions, successful retirement often involves gradually stepping back rather than making abrupt changes.

The Financial Reality Check

Let’s talk numbers, because retirement dreams need financial foundation. While Evans likely has more retirement security than the average American, his planning principles apply universally. The key is understanding what you need and creating a realistic plan to get there.

Current retirement statistics show that the median 401(k) balance for Americans aged 55-64 is around $185,000 according to recent Vanguard data. That might sound substantial, but it only generates about $7,400 annually using the standard 4% withdrawal rule. Combined with Social Security, many retirees face a significant income gap.

Closing the Income Gap

This is where Evans’ systematic approach becomes instructive. He didn’t leave his Congressional career to chance—he planned his transition carefully. You need the same systematic approach to retirement funding:

- Calculate your estimated retirement expenses (start with 70-80% of current income)

- Project your Social Security benefits using the SSA website

- Evaluate your employer-sponsored retirement plan balance and projected growth

- Assess additional savings needs and create a catch-up plan

- Consider working longer or transitioning gradually to bridge any gaps

Don’t let these numbers discourage you. I’ve helped clients successfully retire with far less than the “recommended” amounts by being strategic about timing, location, and lifestyle choices.

The key insight from studying transitions like Evans’ Congressional retirement is that successful retirement requires both financial preparation and emotional preparation. Just as high-performing individuals in any field must balance peak performance with transition planning, your retirement success depends on addressing both the practical and psychological aspects of this major life change.

Healthcare and Long-Term Planning Considerations

One advantage Evans has as a former member of Congress is access to the Federal Employees Health Benefits (FEHB) program in retirement. Most of us need to plan more creatively for healthcare costs, which represent one of the largest and least predictable retirement expenses.

Healthcare planning becomes critical when you’re no longer covered by employer insurance but aren’t yet eligible for Medicare. This gap period—often called the “healthcare gap”—can be expensive and stressful if you haven’t planned for it.

Bridging the Healthcare Gap

Here are strategies to consider for healthcare coverage between employer insurance and Medicare eligibility:

- COBRA continuation coverage (expensive but comprehensive)

- ACA marketplace plans (may qualify for subsidies depending on income)

- Healthcare sharing ministries (limited coverage but lower cost)

- Part-time employment with health benefits

- Spouse’s employer coverage if available

The key is factoring these costs into your retirement planning early. Healthcare expenses in early retirement can easily run $1,500-2,500 monthly for a couple, significantly impacting your required retirement savings.

“Healthcare costs are the wild card in retirement planning. You can’t predict them perfectly, but you can build flexibility into your plan to handle various scenarios.”

— Janet Rodriguez, Retirement Planning Specialist

Learning from Political Career Transitions

Evans’ retirement reflects broader trends in how experienced professionals approach career endings. Unlike previous generations who often retired abruptly at 65, today’s retirees increasingly plan phased transitions that maintain engagement while providing more flexibility.

This trend isn’t limited to politics. Many professionals now “practice” retirement through sabbaticals, reduced work schedules, or consulting arrangements. These approaches allow you to test retirement lifestyle while maintaining some income and benefits.

The Phased Retirement Advantage

Consider the benefits of a gradual transition:

- Continued income while adjusting to retirement lifestyle

- Maintained social connections and sense of purpose

- Opportunity to fine-tune retirement plans before full commitment

- Potential for continued employer benefits during transition

- More time for retirement savings to grow

This approach requires open communication with your employer and careful planning of your benefits, but it can significantly ease both the financial and emotional aspects of retirement transition.

The decision-making process that Evans demonstrated—weighing timing, legacy, and personal readiness—mirrors the complex choices many professionals face. Whether you’re in politics, sports, or any demanding career, the principles of strategic retirement timing remain consistent.

Frequently Asked Questions

Is Dwight Evans back in Congress?

As of current reports, Dwight Evans continues to serve Pennsylvania’s 3rd Congressional District, though he has announced his intention to retire. His retirement timing reflects careful consideration of both personal readiness and political circumstances, demonstrating the importance of strategic timing in any retirement decision.

How long has Dwight Evans been in Congress?

Dwight Evans has served in the U.S. House of Representatives since 2016, following decades of service in the Pennsylvania House of Representatives. His long career in public service provides valuable insights into building a meaningful legacy while preparing for eventual retirement transition.

What was Dwight Evans known for?

Evans built his reputation on education reform, economic development, and urban revitalization efforts. His focus on long-term community building rather than short-term political gains offers lessons for anyone considering their own professional legacy and retirement planning approach.

Who is the congressional rep for Philadelphia?

Philadelphia is represented by several Congress members due to multiple districts. Evans represents Pennsylvania’s 3rd District, which includes parts of Philadelphia. Understanding your representation is important for staying informed about policies affecting retirement benefits and Social Security.

What is the salary of a U.S. congressman?

Members of Congress earn $174,000 annually as of 2024. This salary level provides insight into how public servants plan for retirement, often relying on systematic saving rather than high income to build retirement security—a strategy applicable to many middle-income Americans.

Why is Dwight Evans not in the Hall of Fame?

This question likely refers to baseball player Dwight Evans, not the Congressman. The baseball Hall of Fame has specific criteria for induction, and while many consider Evans worthy based on his career statistics, he hasn’t been selected by voters. This distinction highlights the importance of researching the right person when seeking information.

Is Dwight Evans on the Hall of Fame ballot?

Again, this refers to the baseball player. Former players can appear on Hall of Fame ballots through different processes, including the writers’ ballot and various committees. The political figure Dwight Evans’ legacy will be measured differently, through his legislative achievements and community impact.

Who’s been in Congress the longest?

Several members have served for decades, with some approaching or exceeding 40 years of service. Long tenure in Congress often provides greater retirement security through the federal pension system, highlighting the value of consistent, long-term employment for retirement planning regardless of your career field.

Your Next Steps in Retirement Planning

Watching how experienced leaders like Evans approach retirement transitions offers valuable lessons for your own planning. The key insight is that successful retirement isn’t just about accumulating enough money—it’s about creating a comprehensive transition plan that addresses financial security, personal purpose, and legacy considerations.

Start by evaluating where you are in your own retirement planning journey. Are you like Evans, with a clear timeline and systematic approach? Or are you still in the early stages of thinking about what retirement might look like? Either way, the principles remain the same: start planning early, think beyond just finances, and remember that retirement is a transition, not a destination.

Take action this week by scheduling a comprehensive review of your retirement accounts, calculating your projected Social Security benefits at SSA.gov, and honestly assessing both your financial readiness and emotional preparation for this major life transition. Your future self will thank you for the attention you give to retirement planning today.

Disclaimer: This article provides educational information about retirement planning strategies inspired by public career transitions. It is not personalized financial, legal, or tax advice. Your situation is unique—please consult with qualified professionals before making significant financial decisions. For specific information about Social Security benefits and federal retirement programs, visit official government websites.