Table of Contents

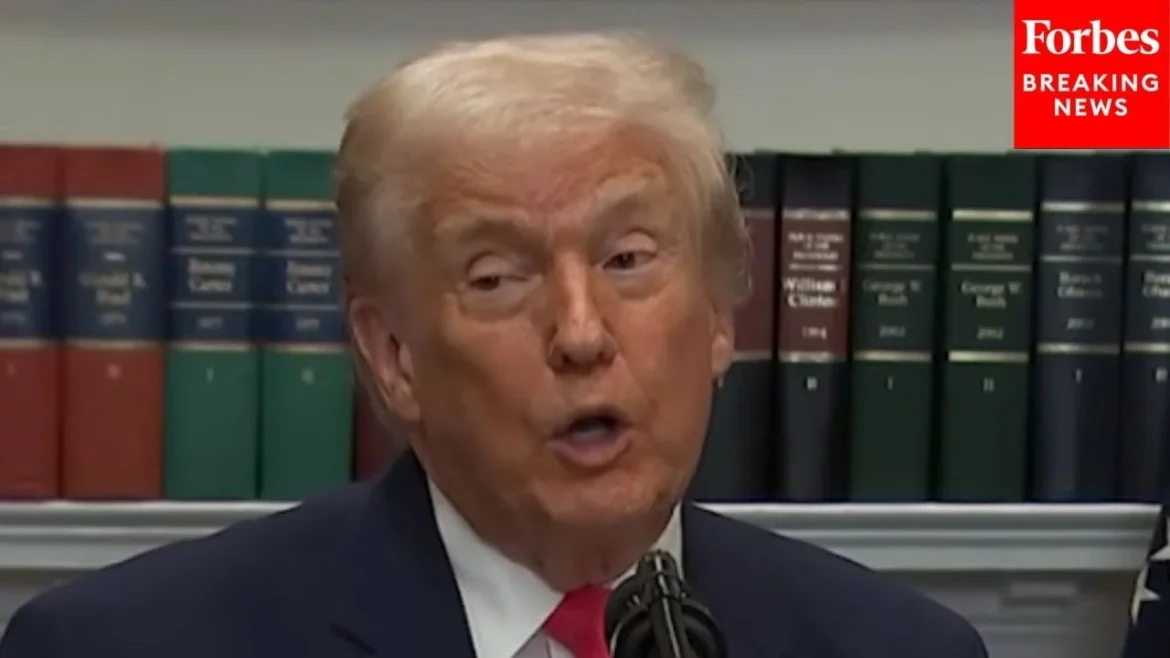

I’ve sat across from countless clients over the years who all wished they had a crystal ball to predict their retirement finances. Now, imagine a system that aims to take some of that guesswork out of the equation. There’s been a lot of buzz lately because Trump said he’s looking into an Australian-style retirement program for America. While the idea of a new approach to retirement planning might sound daunting, it’s worth understanding what this could mean for your financial future. As someone who’s guided many through their retirement journey, I know the anxiety that can come with an uncertain future.

If you’re wondering how an “Australian-style” program works and what its implications might be for your golden years, you’ve come to the right place. We’re going to dive into the core components of Australia’s superannuation system, explore its potential benefits and challenges if adapted for the U.S., and discuss what you can do today to strengthen your own retirement savings, regardless of what policies emerge from Washington. This article will demystify the concept, help you understand the current conversation, and arm you with actionable insights.

Key Points

- Australia’s Superannuation is a mandatory employer contribution retirement system.

- It mandates employer contributions into individual retirement accounts for employees.

- The proposed U.S. adaptation aims to boost national retirement savings.

Understanding Australia’s Superannuation System: A Potential Model for the U.S.

So, what exactly is this Australian-style retirement program that might be coming to America? It’s formally known as “Superannuation” (or “Super,” as the Aussies call it), and it’s fundamentally different from our current, largely voluntary, system here in the U.S. At its core, Superannuation is a compulsory system where employers are required by law to contribute a percentage of an employee’s earnings into a designated retirement fund.

Think of it as a nationwide, mandatory 401(k) enrollment where your employer is legally obligated to contribute on your behalf. This isn’t just about encouraging savings; it’s about ensuring a baseline level of retirement security for almost every working Australian. It’s truly a societal approach to retirement planning, moving beyond relying solely on individual initiative or Social Security.

Historically, Australia implemented this system to reduce reliance on the aged pension (their version of Social Security) and to ensure a more robust retirement for its citizens. It’s been quite successful, making Australia’s retirement savings pool one of the largest globally. If Trump said he’s looking into an Australian-style retirement program for America, he’s likely eyeing this compulsory, employer-driven contribution model as a way to address our own looming retirement crisis.

How Does Superannuation Work in Practice?

Let’s break down the mechanics. For most Australian employees, the system operates like this:

- Mandatory Contributions: Employers must contribute a percentage of an employee’s ordinary time earnings into a Super fund. This percentage, known as the “Super Guarantee (SG),” is currently 11% and is scheduled to gradually increase.

- Individual Accounts: While mandatory, these contributions go into individual, portable accounts for each employee. This isn’t a collective pot like Social Security; it’s a personal investment fund managed by licensed Super funds.

- Investment Choices: Employees usually have a choice of Super funds and investment options within those funds, ranging from conservative to aggressive. If no choice is made, employers often default to a MySuper product, which is a standardized, low-cost option.

- Preservation Age: Funds are generally “preserved,” meaning they cannot be accessed until the individual reaches a certain “preservation age” (currently between 55 and 60, depending on birth year) and meets a condition of release (like retirement).

- Tax Advantages: Contributions and earnings within Super are taxed at favorable rates, below standard income tax rates, encouraging growth. Withdrawals in retirement are often tax-free if certain conditions are met.

“The beauty of the Superannuation system is its universality. It ensures that even those who might not prioritize saving, or who work for employers without traditional retirement plans, still accumulate a significant nest egg.”

— Olivia Chen, Financial Strategist

The Australian government even provides a handy resource explaining the Super system if you’d like to dig deeper into the specifics, available on their Australian Taxation Office website. It highlights the direct link between employer contributions and individual financial security.

Why the U.S. is Looking Down Under for Retirement Solutions

The U.S. faces significant retirement challenges. Many Americans aren’t saving enough, and a substantial portion of the workforce lacks access to employer-sponsored retirement plans. Our reliance on voluntary savings, often coupled with the complexities of navigating various investment options, leaves a lot of people vulnerable as they approach their later years.

When Trump said he’s looking into an Australian-style retirement program for America, it wasn’t just a casual remark; it reflects a growing concern across the political spectrum about the sustainability of our current retirement landscape. The appeal of a mandatory, employer-contributed system like Australia’s is clear: it simplifies the process and ensures broad participation, potentially boosting national savings rates dramatically.

Potential Benefits for Americans

If a similar system were implemented here, we could see several benefits:

- Increased Savings for All: A mandatory system would mean nearly every working American would have retirement savings building up from their first paycheck. This would be a game-changer for those without 401(k)s or who struggle to save consistently.

- Reduced Reliance on Social Security: With more personal savings, the strain on Social Security could be lessened, potentially ensuring its solvency for future generations.

- Simplified Retirement Planning: For many, the “default” nature of such a system would take much of the burden of initiation off individual shoulders, though investment choices would still exist.

- Portability: Like Australia’s Super, a U.S. version would likely feature portable accounts that follow you from job to job, eliminating the problem of scattered 401(k)s or lost pensions.

This isn’t to say it would be a panacea. There are considerable hurdles too, but the potential to strengthen the financial standing of millions of retirees is a powerful motivator for exploring such an idea.

The Hurdles and Challenges to a U.S. Super System

While the concept sounds appealing, transplanting Australia’s Superannuation system directly to the U.S. is far from simple. We have a vastly different economic, political, and cultural landscape. Think about the complexities of integrating Medicare into retirement expenses; now imagine overhauling the entire savings framework.

Key Obstacles to Implementation

- Political Will and Public Acceptance: Mandating employer contributions, even if beneficial long-term, would face significant political opposition. Many Americans are wary of government mandates, especially concerning personal finances.

- Employer Burden: Small businesses, in particular, could struggle with the administrative costs and cash flow impact of mandatory contributions, even if they replace other benefits.

- Impact on Wages: Economists debate whether mandatory employer contributions ultimately come out of employee wages or are entirely new compensation. If it’s the former, workers might feel they’re not earning more, just having money redirected.

- Investment Landscape: Our financial industry is vast and complex. Integrating a new mandatory system with existing 401(k)s, IRAs, and pensions would be an immense undertaking.

- Social Security Integration: How would a new system interact with Social Security? Would it reduce future Social Security benefits, or complement them? This is a critical detail that would need careful consideration.

These are not minor challenges, and any implementation would require a thoughtful, phased approach. However, the fact that Trump said he’s looking into an Australian-style retirement program for America signals a willingness to think outside the traditional box for solutions to our nation’s retirement security challenges.

What This Means for Your Retirement Planning Now

Regardless of whether an Australian-style system ever becomes a reality in the U.S., the conversation itself serves as an important reminder: proactive retirement planning is crucial. While policymakers discuss grander schemes, you have control over your individual financial future.

Here’s what I tell my clients:

- Maximize Your Current Options: If you have a 401(k) or similar workplace plan, contribute at least enough to get the full employer match—it’s free money! If you don’t have a workplace plan, consider opening an Individual Retirement Account (IRA), either traditional or Roth, depending on your income and tax situation. The IRS provides excellent resources on IRA contribution limits and eligibility each year.

- Diversify Your Savings: Don’t put all your eggs in one basket. Balance your traditional pre-tax accounts with Roth options for tax diversification in retirement. Consider health savings accounts (HSAs) for their powerful triple tax benefits if you have a high-deductible health plan.

- Educate Yourself: Stay informed about different investment options, fees, and market trends. Understanding the basics will empower you to make better decisions for your unique situation.

- Review Regularly: Life changes, and so should your financial plan. Review your savings rate, investment allocations, and retirement goals at least annually.

- Consult a Professional: This article provides educational information about retirement planning strategies. It is not personalized financial, legal, or tax advice. Your situation is unique—please consult with qualified professionals before making significant financial decisions. A CERTIFIED FINANCIAL PLANNER™ can help you tailor a strategy that aligns with your goals and risk tolerance.

Even if an Australian-style system were adopted, it would likely be years away, and existing savings would remain under your purview. So, continue to save diligently, invest wisely, and plan strategically. This will put you in the strongest position, no matter what changes may come.

Frequently Asked Questions About Retirement Programs

What is Australia’s retirement program?

Australia’s retirement program, known as Superannuation or “Super,” is a mandatory system where employers are legally required to contribute a percentage of an employee’s earnings into a personal retirement fund. These funds are invested by licensed Super funds and are generally accessible only upon reaching a specific preservation age and condition of release, like retirement.

Is Australia’s Superannuation similar to Social Security?

No, Superannuation is distinctly different from Social Security. Social Security is a government-run, pay-as-you-go system providing benefits from a collective fund. Superannuation, however, involves mandatory employer contributions into individual, privately managed investment accounts, making it more akin to a mandatory 401(k) or IRA.

Would a U.S. version of Superannuation replace 401(k)s or IRAs?

It’s highly unlikely that a U.S. Superannuation system would fully replace existing 401(k)s or IRAs. More probably, it would be designed to complement them, especially targeting the millions of American workers who currently lack access to any workplace retirement plan. This would ideally create a baseline of retirement savings for a broader population.

How would a mandatory contribution system affect my take-home pay?

The economic impact on take-home pay is a complex issue. Some economists argue that mandatory employer contributions would eventually lead to lower wage growth, as employers factor these costs into overall compensation. Others suggest it could be seen as an additional benefit, separate from direct wages. This would be a major point of debate during any legislative consideration.

Conclusion: Stay Proactive, Stay Informed

The discussion around whether Trump said he’s looking into an Australian-style retirement program for America is a fascinating one, highlighting a real and pressing need to shore up our nation’s retirement security. While the specifics of any potential U.S. adaptation are still hypothetical and would involve immense political and economic challenges, the core idea of ensuring greater participation in retirement savings is undoubtedly appealing.

For you, the individual saver, the takeaway is clear: don’t wait for policy changes. Take control of your retirement today by maximizing the tools available to you—your 401(k), IRA, HSA, and other investment vehicles. Build a robust financial plan, educate yourself, and seek professional guidance when needed. By doing so, you’ll be well-positioned to navigate any future changes and enjoy the comfortable retirement you’ve worked so hard for.

Next Steps for Your Retirement Planning:

- Review your current employer-sponsored retirement plan contributions.

- Consider opening or increasing contributions to an IRA or Roth IRA.

- Schedule a financial review with a qualified advisor to assess your readiness for retirement.