Table of Contents

The recent Dow Jones Futures Rise signals potential recovery after a challenging week marked by an Nvidia-led market sell-off that sent shockwaves through retirement portfolios nationwide. If you’re approaching retirement and watching your 401(k) balance swing like a pendulum, you’re not alone—and more importantly, you’re not helpless in this situation.

Market volatility like this can feel especially nerve-wracking when you’re within 10-15 years of retirement. But here’s what I’ve learned after helping hundreds of pre-retirees navigate market turbulence: understanding these market movements and having a solid strategy can actually strengthen your retirement position rather than derail it.

Understanding Market Futures and Your Retirement Strategy

Let’s start with the basics that many pre-retirees ask me about. The Dow Jones futures are essentially contracts that allow investors to bet on where the Dow Jones Industrial Average will be at a future date. Think of it as a preview of market sentiment—when Dow Jones Futures Rise, it typically indicates optimism about the next trading session.

But here’s what matters more for your retirement planning: these daily fluctuations, while attention-grabbing, are just noise in the context of your 20-30 year retirement timeline. I’ve seen too many people make costly retirement decisions based on short-term market movements that ultimately proved irrelevant to their long-term success.

What Really Makes Markets Move

Several factors contribute to market rises and falls, and understanding them can help you maintain perspective during volatile periods:

- Economic indicators like employment rates, inflation data, and GDP growth

- Federal Reserve policy decisions and interest rate changes

- Corporate earnings reports and forward guidance

- Geopolitical events and global economic developments

- Investor sentiment and market psychology

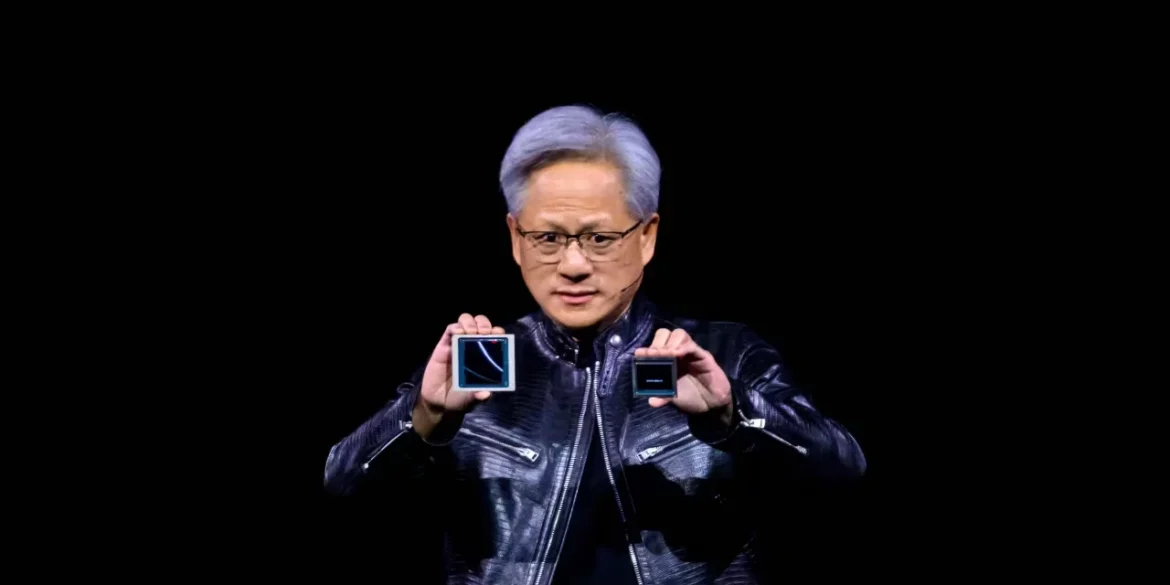

The recent sell-off triggered by concerns about artificial intelligence valuations, particularly around companies like Nvidia, demonstrates how quickly sentiment can shift. However, retirement accounts like 401(k)s and IRAs are designed to weather these storms through diversification and time.

Bitcoin and Alternative Investments in Retirement Portfolios

The mention of Bitcoin trying to halt its slide brings up an important question I hear frequently: should cryptocurrency have a place in retirement planning? The answer isn’t black and white, but it requires careful consideration of your risk tolerance and timeline.

For most pre-retirees, I recommend treating cryptocurrency as a small speculative position—typically no more than 5% of your total portfolio. The volatility that makes Bitcoin exciting for younger investors can be devastating for someone who needs their portfolio to provide steady income in retirement.

“The biggest mistake I see pre-retirees make is chasing performance with investments they don’t fully understand, especially when market headlines create fear or greed.”

— Michael Rodriguez, CFP®

Instead of focusing on the latest market drama, successful retirees concentrate on building diversified portfolios that can generate income regardless of whether the Dow Jones Futures Rise or fall on any given day.

The 80% Rule and Risk Management for Retirement

Speaking of risk management, let me address the 80% rule in futures trading—a concept that has important implications for retirement planning, even if you never trade futures yourself. This rule suggests that 80% of futures traders lose money, highlighting the speculative nature of these instruments.

The lesson for retirement planning is clear: avoid speculative strategies with money you can’t afford to lose. Your retirement savings should be invested in well-diversified portfolios of stocks, bonds, and other traditional assets that have proven track records over decades.

Building a Market-Resilient Retirement Plan

Here’s how to construct a retirement strategy that can handle market volatility:

- Maintain 3-5 years of expenses in conservative investments (bonds, CDs, money market funds)

- Keep your stock allocation appropriate for your age and risk tolerance

- Rebalance regularly to maintain your target asset allocation

- Consider dividend-paying stocks for income generation

- Don’t abandon your strategy during market downturns

I’ve watched clients who stuck to their plans through the 2008 financial crisis, the 2020 pandemic sell-off, and numerous other market disruptions come out ahead of those who tried to time the market. Research from major financial institutions consistently shows that time in the market beats timing the market.

Protecting Your Retirement from Market Volatility

When news breaks about market sell-offs or when Dow Jones Futures Rise dramatically, it’s natural to feel anxious about your retirement security. However, there are proven strategies to protect yourself from market volatility without abandoning growth potential entirely.

Dollar-cost averaging is one of the most effective tools for pre-retirees. By consistently investing the same amount regardless of market conditions, you automatically buy more shares when prices are low and fewer when they’re high. This strategy has helped countless people build substantial retirement wealth despite market ups and downs.

The Importance of Diversification Beyond Stocks

While stocks get most of the headlines, a well-rounded retirement portfolio includes multiple asset classes. Consider these often-overlooked components:

- Treasury Inflation-Protected Securities (TIPS) to guard against inflation

- International stocks for global diversification

- Real estate investment trusts (REITs) for property exposure

- High-quality corporate bonds for steady income

The goal isn’t to eliminate risk—that’s impossible and would likely mean your money won’t grow enough to support your retirement. Instead, you want to manage risk appropriately for your situation and timeline.

Remember that Social Security benefits will likely form a foundation of your retirement income, providing some protection against market volatility. This guaranteed income source allows you to take appropriate risks with your other retirement savings.

Taking Action During Market Uncertainty

Market volatility often presents opportunities for savvy retirement planners. When markets decline, you might consider Roth IRA conversions, which allow you to pay taxes on retirement funds at potentially lower values and enjoy tax-free growth going forward.

Similarly, market downturns can be excellent times to rebalance your portfolio, selling high-performing bonds to buy stocks at reduced prices. This disciplined approach has helped many retirees build wealth during periods when others were paralyzed by fear.

If you’re still working and contributing to retirement accounts, market declines mean your contributions are buying shares at lower prices. Many successful retirees actually increased their savings rates during market downturns, taking advantage of dollar-cost averaging when shares were “on sale.”

Frequently Asked Questions

What is the Dow Jones futures?

Dow Jones futures are financial contracts that allow investors to speculate on the future direction of the Dow Jones Industrial Average. These contracts trade on exchanges and provide an indication of market sentiment before the stock market opens. For retirement planning purposes, futures serve as a barometer of short-term market expectations but shouldn’t drive long-term investment decisions.

What makes the Dow rise?

The Dow Jones Industrial Average rises when the stock prices of its 30 component companies increase on average. Factors include positive corporate earnings, favorable economic data, optimistic investor sentiment, and supportive monetary policy. However, daily movements often reflect short-term emotions rather than fundamental economic changes that matter for long-term retirement planning.

What is a dow jones?

The Dow Jones, formally known as the Dow Jones Industrial Average (DJIA), is a stock market index that tracks 30 large, publicly-owned companies in the United States. Created in 1896, it serves as one of the most widely-followed indicators of U.S. stock market performance. For retirees, it represents just one measure of market health among many.

What is the 80% rule in futures trading?

The 80% rule suggests that approximately 80% of futures traders lose money, highlighting the speculative and risky nature of futures trading. This statistic underscores why retirement funds should focus on diversified, long-term investment strategies rather than speculative trading. The rule serves as a reminder that attempting to profit from short-term market movements often leads to losses.

Moving Forward with Confidence

While headlines about market volatility and dramatic moves when Dow Jones Futures Rise can create anxiety, remember that successful retirement planning is built on time-tested principles, not daily market movements. The investors who retire comfortably are those who maintain diversified portfolios, contribute consistently, and avoid emotional decision-making during volatile periods.

Your retirement success won’t be determined by whether you perfectly navigate every market downturn or capitalize on every rally. Instead, it depends on starting early, saving consistently, maintaining appropriate risk levels, and staying the course through inevitable market cycles.

If recent market volatility has you questioning your retirement strategy, consider this an opportunity to review and strengthen your plan rather than abandon it. Work with a qualified financial advisor to ensure your portfolio aligns with your retirement timeline and risk tolerance. Most importantly, remember that building wealth for retirement is a marathon, not a sprint—and you’re more prepared for this journey than you might think.

Disclaimer: This article provides educational information about retirement planning and market concepts. It is not personalized financial advice. Market investments carry risk, including potential loss of principal. Consult with a qualified financial advisor before making investment decisions or significant changes to your retirement strategy.